"Stablecoins: Redefining Stability in the Cryptocurrency Era"

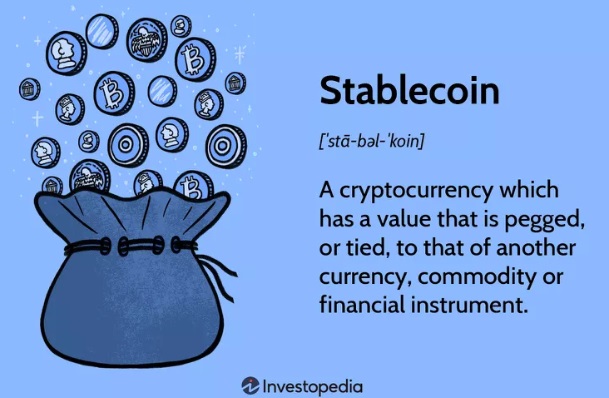

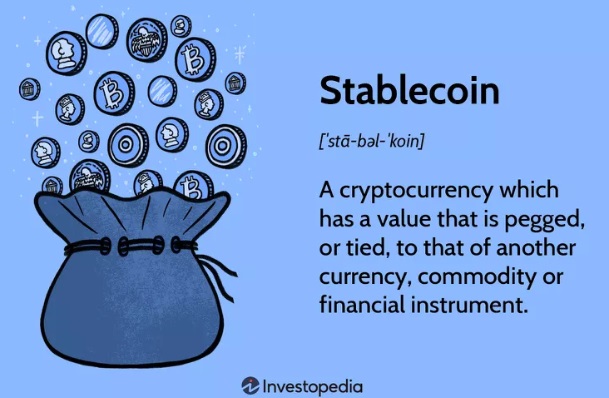

What Is a Stablecoin?

As the cryptocurrency market evolves, stablecoins have become a key innovation, addressing the volatility typical of traditional cryptocurrencies like Bitcoin and Ethereum. Designed to maintain a stable value, often pegged to fiat currencies like the US Dollar or assets like gold, stablecoins offer predictability, making them practical for various financial applications. They achieve stability through mechanisms such as collateralization with fiat or cryptocurrencies, or algorithmic control. Different types include fiat-collateralized (e.g., USDC, Tether), crypto-collateralized (e.g., DAI), and algorithmic stablecoins (e.g., TerraUSD).

Challenges and Future Prospects

Despite their advantages, stablecoins face challenges like regulatory scrutiny, collateral management, and the stability of algorithmic models. Governments and regulators are increasingly concerned about their impact on financial stability and consumer protection. Nonetheless, as technology advances and regulatory frameworks mature, stablecoins are likely to play a significant role in the future of finance. They offer a stable alternative to traditional cryptocurrencies, enhancing financial inclusion and streamlining transactions, potentially bridging the gap between traditional and digital financial systems.