Sports Industry: Under-the-Radar Shifts and Opportunities (2025–2030)

A vast untapped market lies in the rising number of physically inactive people worldwide. Rather than targeting only avid athletes, sports companies are eyeing the 31% (and growing) of adults who are inactive as potential new customers

Turning Inactivity into Opportunity: Engaging this segment – for example, through beginner-friendly fitness tech or community sports programs – is a niche growth path not widely covered in mainstream sports discussions. McKinsey notes that reversing the physical inactivity trend could unlock significant new demand for sporting goods and services

Blending Sports with Entertainment Experiences: The business of sports is evolving beyond the game itself. Live sports events are increasingly fused with entertainment – from in-stadium concerts and festivals to augmented reality fan experiences – creating new revenue streams . This “sportainment” trend is underreported, yet it’s accelerating. McKinsey observes a “boom of blended live sports and entertainment”, as teams and leagues turn games into immersive spectacles to boost attendance and engagement . The rise of celebrity-owned exhibition matches, halftime shows rivaling music festivals, and e-sports tournaments with live audiences all point to sports morphing into broader entertainment platforms.

Explosion of New Leagues and Niche Sports:

Beyond the headline sports, a proliferation of new and niche leagues is quietly reshaping the global sports landscape. Women’s professional leagues are expanding at an unprecedented pace (e.g. WNBA adding teams, new women’s hockey leagues), and non-traditional sports like cricket’s T20 leagues, kabaddi, or paddle tennis are drawing investment . Deloitte reports a “global surge of new sports leagues, teams, and events”, enabled by digital distribution and private investors seeking growth beyond saturated major leagues . This fragmentation of the sports market – with emerging sports vying for fan attention – is a niche trend that could yield big payoffs in regions or demographics that mainstream sports have underserved.

Data Monetization and Fan Personalization:

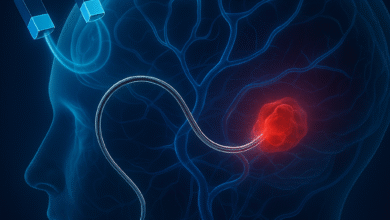

Sports businesses are leveraging data analytics and AI in novel ways that haven’t hit mainstream awareness. From real-time athlete performance data to personalized fan content feeds, data is becoming a core asset. Teams and leagues are harvesting troves of fan data (via apps, streaming, stadium sensors) to deliver tailored experiences and targeted sponsorships . This raises privacy-first innovation opportunities – for example, new platforms that give fans control of their data in exchange for rewards. While casual observers see the excitement on the field, behind the scenes a quiet shift is underway: sports organizations acting more like tech companies, monetizing fan engagement algorithms and even exploring blockchain tokens for fan loyalty. These data-driven business models remain underreported but could redefine sports revenue streams in the next five years.